USER LOGIN

An NBS Staff will get in touch with you as soon as possible

NBS manages your investments to generate higher returns.

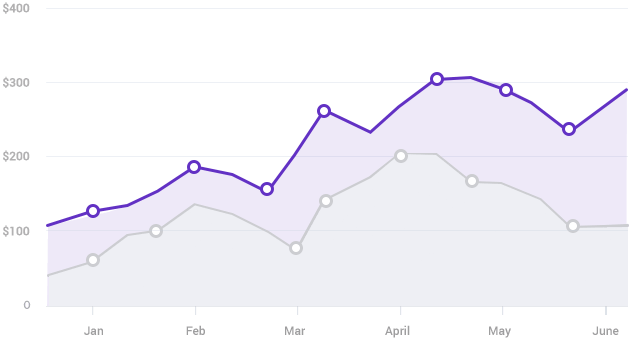

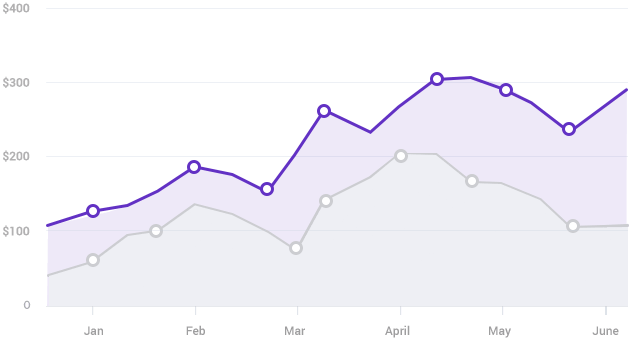

It is clear from the graph that equity has generated the highest post tax returns compared to all other asset classes. However, an actively managed investment has the potential to generate even higher returns. This is where NBS plays a major role. The NBS team analyses and identifies stocks with high potential of return and higher margin of safety.

India has an incredible economic growth potential for the long term and it is just getting started, be one of the early investors in this growth story.

India is a consumption based economy and as the income of the people in the second highest populated nation in the world increases, so will the demand; this will lead to an explosion in the consumption trends and benefit all market segments.

Indian markets are acquiring more maturity by the day which has led to a welcome increase in volumes. Due to this, holding shares in Demat account has become as effective as holding cash in your bank account.

SEBI and other regulators ensure highest level of transparency and technology that are at par with global markets. Investor can access their portfolio from anywhere in the world

IPO (Initial Public Offering) is a companys' way of entering into the stock market. This gives investors a new avenue to invest in. According to recent reports investment made in IPOs' generated an annualised return of 34.34% which is more than double of the returns generated by BSE index as a whole during the same period. Generally, Companies raise money through the route of IPO when they have strong financials to back their offer price. This in turn ensures a certain level of safety. NBS helps you identify better IPOs’ among the various IPO listings.