The Public Provident Fund (PPF) and equity-linked saving schemes (ELSS) are popular investment options that both qualify for income tax deductions...

USER LOGIN

An NBS Staff will get in touch with you as soon as possible

NBS offers the right blend of Financial Products & Services to satisfy all your financial requirements

NBS provides Portfolio Restructuring Services and advisory to all its clients in order to maximize their returns

NBS strives to provide information and educate clients on the latest products and services being offered in the Financial space to maximize their Wealth

NBS Specialises in handling all compliance related to NRI Investments in Indian Markets from account opening to filing taxes

At NBS, we follow Value Investment principles of Global

Investment Guru Warren Buffet

We select stock based on fundamentals.

We select stock based on fundamentals.

We handpick stocks as per clients' profile.

We handpick stocks as per clients' profile.

We regularly monitor our clients' portfolio.

We regularly monitor our clients' portfolio.

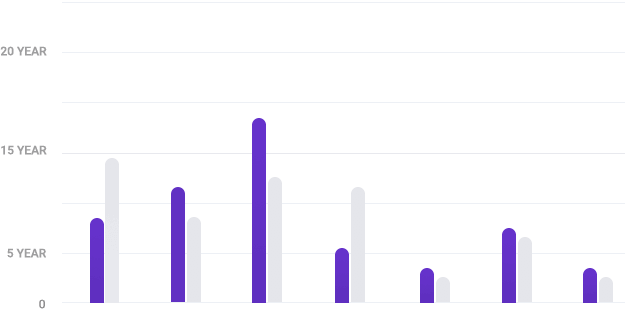

As seen in the graph, Equity outperforms all other asset classes.

As seen in the graph, Equity outperforms all other asset classes.

The Public Provident Fund (PPF) and equity-linked saving schemes (ELSS) are popular investment options that both qualify for income tax deductions...

Role of mutual funds in your retirement planning

If you are a Central Government employee, most of the financial aspects of your retirement are already sorted by the government....

These bonds are fixed debt instruments issued by the government -- either in domestic or foreign currencies -- and it's as good as raising...

True, unfiltered & unedited opinions about NBS from our clients.

True, unfiltered & unedited videos about NBS from our clients.

Provide us with your details and we'll

get back to you.

Call us now

022 25303690

Get in touch

info@nidhibroking.com

whatsapp us now

+91 8655966973